Content

Accounting materials and office supplies are crucial in allowing companies to carry out administrative work. Capital expenditures include any expenses incurred on fixed assets. However, for companies to capitalize on these expenses, it is crucial that they improve the asset. Capital expenditures include costs borne on maintaining or expanding a business to generate additional profits. These will involve acquiring fixed assets, such as buildings, plants, machinery, etc. Therefore, these expenses are shown in expenses side of profit and loss account.

It’s important to correctly classify your office expenses, supplies, and equipment to make things easier for tax time. Extraordinary expenses are costs incurred for large one-time events or transactions outside the firm’s regular business activity. They include laying off employees, selling land, or disposal of a significant asset. Under cash accounting, the expense is only recorded when the actual cash has been paid. The purchase of an asset such as land or equipment is not considered a simple expense but rather a capital expenditure.

Want More Helpful Articles About Running a Business?

In regular business, many petty expenses are incurred for the smooth functioning of the business. However, these expenses are neither regular in nature nor significant in amount. Also, these expenses don’t fit into other standardized general ledger accounts such as Wages, Salaries, Advertisements, etc., to name a few. For corporations, show these expenses in the “Other Deductions” section of Form 1120. First, you must include a statement listing the deductions, then include the total on “Other Deductions,” Line 26. These expenses are used for the operations of the office, so they are often called “office operating expenses.”

Consolidated Maintenance Capital Expenditures shall be calculated over the four fiscal quarters immediately preceding the date of determination thereof. What is the effect on the current ratio of 1) inventory purchased for cash, and 2) equipment purchased for cash? 1) decrease; 2) increase.1) decrease; 2) decrease.1) decrease; 2) no effect. Not-for-Profit Organisations like sports is stationery used an expense clubs have sports material as consumable items which are charged to Income and Expenditure A/c. Income and Expenditure A/c will show correct Surplus/Deficit when adjusted sports material consumed is debited to the account. Sports material consumed during the year is derived by making adjustments related to the purchase of sports material and the cost of sports material consumed.

Is supplies an asset on a balance sheet?

You must attach a separate statement breaking down the different deductions included in this line item. To take the cost of this item as a deduction, you must also treat the item as an expense on your accounting system. It used to be that all business assets that cost more than $500 had to be depreciated.

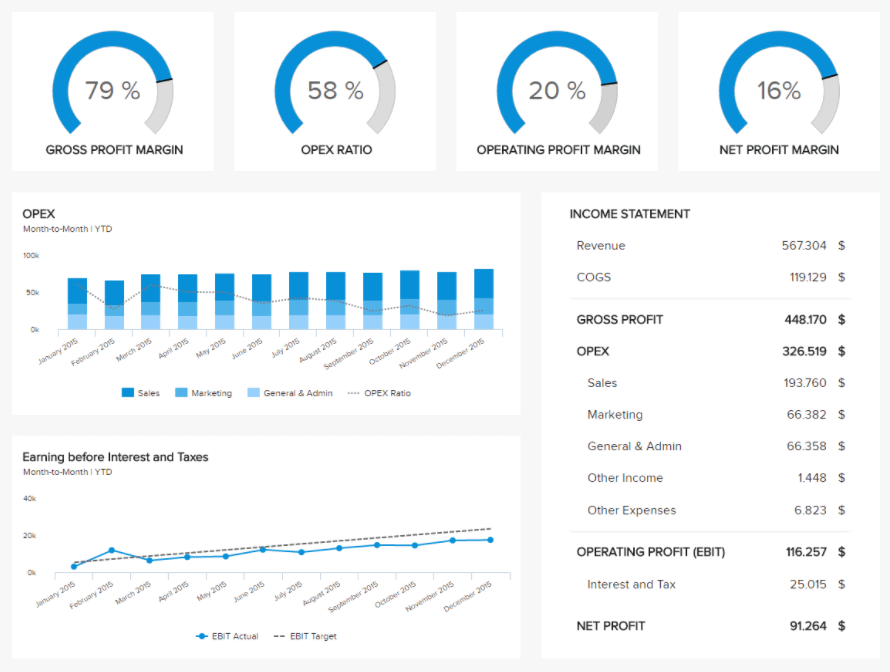

Accrual accounting is based on the matching principle that ensures that accurate profits are reflected for every accounting period. The revenue for each period is matched to the expenses incurred in earning that revenue during the same accounting period. For example, sale commission expenses will be recorded in the period that the related sales are reported, regardless of when the commission was actually paid. Consider the previous example from the point of view of the customer who pays $1,800 for six months of insurance coverage. Initially, she records the transaction by increasing one asset account with a debit and by decreasing another asset account with a credit.

Connect With a Financial Advisor

When it comes to accounting materials and office supplies, the accounting treatment is that of revenue expenditures. It is because these materials and supplies do not fulfill the definition of capital expenditure. Neither do these items expand a business or generate additional profits.

Is stationery an expense?

Stationery will be considered as an asset if someone is dealing in stationeries, while it can be considered as an expense if someone is buying it for the business.

Remember that these transactions will impact both your balance sheet and your income statement, so it’s important to record them properly. Unless you purchase in bulk for the upcoming year, your office expenses will simply be office expenses. The easiest way to classify office supplies, expenses, and equipment is to look at each purchase separately and decide how it should be classified. A Business ExpenseBusiness expenses are those incurred in order to successfully run, operate, and maintain a business. Travel & conveyance, salaries, rent, entertainment, telephone and internet expenses are all examples of business expenses. Yes, salary is considered an expense and is reported as such on a company’s income statement.

The indirect and direct methods of preparing the statement of cash flows are identical except for thesignificant non-cash activity section. The amount of office supplies used during a specified time interval. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Examples of office supplies are desk supplies, forms, light bulbs, paper, pens and pencils, and toner cartridges. Office supplies may or may not be a current asset depending on their cost.

More specifically, if these costs are material, then companies may capitalize the amount. However, small items will end up as an expense in the financial statements. This decision will ultimately come down to the company’s policies. In the world of accounting, every business transaction involves at least two accounts. An expense is a cost you incur during the normal operating activities of your business. According to AccountingTools, when you debit office supplies as an expense to an account such as Office Supplies, you would credit a Cash account if you paid for the supplies with cash.

دیدگاه خود را به اشتراک بگذارید